Before deciding on a Medicare Supplement plan, you should take some time to educate yourself about the options available. Medicare Supplemental plans in Texas offer comprehensive coverage for those who are not covered by traditional Medicare. These plans are designed to supplement Medicare coverage and provide benefits that go beyond the basics. Participants can choose from a variety of plans, all of which have been tailored to meet the needs of Texas residents. If you’re looking for comprehensive coverage for your medical needs, Medicare supplemental plans in Texas may be the right choice for you.

Table of contents

- What are Medicare Supplemental plans?

- Types of Medicare Supplemental plans

- How do Medicare Supplemental plans work?

- Coverage of Medicare Supplemental plans

- Costs and premiums for Medicare Supplemental plans

- Do you need Medicare supplement?

- Best Medicare Supplement Plans in Texas

- Eligibility checklist for Medicare Supplemental Plans in Texas

- How to Choose a MediGap Plan in Texas?

- What is the cost of Medicare Plan G in Texas?

- The 10 Standard Medicare Supplement Insurance Plans

- Who Has the Best Medicare Supplemental Plan in Texas?

What are Medicare Supplemental plans?

Medicare Supplemental Plans in Texas

Buying a Medicare Supplement plan in Texas can be a confusing process. Whether you are a first time buyer or an existing beneficiary, there are a lot of things to consider.

Before deciding on a Medicare Supplement plan, you should take some time to educate yourself about the options you have available. A licensed insurance agent can help you find a plan that is suited for your needs. You may have to pay extra for some features, such as foreign travel emergency coverage.

You should also look for a plan that works well with your original Medicare plan. Depending on your needs, you might be able to combine a Medicare Supplement plan with a Medicare Part D prescription drug plan.

When choosing a Medicare Supplement plan, you should consider your age, gender, plan type, and out-of-pocket costs. If you’re looking for the best value for your money, you should compare plans and costs from several companies.

Types of Medicare Supplemental plans

Medicare Supplemental Plans in Texas

Choosing the best Medicare Supplemental plan in Texas can be a daunting task. It is important to compare plans for both coverage and costs. Also, different plans may be better than others. Using a reputable agency can help you decide on the best plan for your health care needs.

The most common pricing style used in Texas is Attained-Age pricing. This means the premium you pay each month is based on your age when you enroll in the plan. As you get older, your premiums will increase.

Another type of pricing style is Community-Rated pricing. The premium you pay each month is fixed, regardless of your age. However, some private fee-for-service plans have a lower cost network.

You can also choose a lettered supplemental insurance plan. These are similar to Medigap plans, but some may not offer prescription drug coverage. They have different premiums, but they may also include dental, vision, hearing, and foreign travel emergency coverage.

How do Medicare Supplemental plans work?

Medicare Supplemental Plans in Texas

Whether you are newly enrolled in Medicare or have been for some time, it is important to understand how Medicare Supplemental plans work in Texas. These plans are designed to fill gaps in original Medicare coverage. They work with any doctor or hospital accepting Medicare. The coverage is guaranteed and renewable.

The Medicare Supplemental plans in Texas vary in cost and benefits, and some may require you to pay additional premiums. You can find out more about the plans by contacting a local licensed agent. If you need assistance, the Social Security Administration has an unbiased counselor available to assist you.

When comparing Medicare Supplemental plans in Texas, you should consider all the options available in your area. You will want to compare the plans’ pros and cons to determine which plan is the most suitable for your needs. You will also need to estimate your out-of-pocket costs to see which plan will be the best fit for you.

Coverage of Medicare Supplemental plans

Texans have several options when it comes to Medicare Supplemental plans coverage. You can find both high deductible and standard plan options. Some insurers even offer discounts to members. Choosing the right plan is important. You should compare the carrier and plan ratings to find the best deal.

Texas Medicare Resources

A free helpline is available in Texas to help residents navigate the complexities of Medicare. Call 800-252-9240.

The State Health Insurance Assistance Program (SHIP) is a free resource. They can help you answer your questions and resolve problems. You can contact them by phone or in person. They also have a list of Medicare contacts.

Choosing the best Medigap plan is important. The best one is the one that offers the highest level of coverage. You should also consider whether you need coverage for out-of-state specialty clinics. You may want to buy a plan with a larger network of providers.

Costs and premiums for Medicare Supplemental plans

Medicare Supplemental Plans in Texas

Those looking for Medicare Supplemental plans in Texas will find a number of plans to choose from. Some are better than others, and the costs and premiums will vary from one plan to the next. It’s important to know what your options are before making a final decision.

One of the most common Medicare Supplement plans in Texas is Plan G, which costs an average of $147 per month. This is the best coverage for people who are newly enrolled in Medicare. Plan G also provides coverage for excess charges. Plan N, meanwhile, is the least expensive of the four Medigap plans. This plan is a great choice for budget shoppers.

Medigap plan costs and premiums are regulated by the federal government and state laws. They also vary by gender, age, and insurance carrier. The best Medicare Supplement plan isn’t the best for your neighbor. It’s always best to shop around for the best price.

Do you need Medicare supplement?

Medicare Supplemental Plans in Texas

Whether you are buying Medicare Supplement in Texas or in any other state, you should compare your options for coverage to make sure you are getting the best deal. Plan costs, coverage levels, and out-of-pocket costs may vary significantly from area to area.

If you are nearing the age of 65, you should sign up for a Medigap policy to help pay for health care costs not covered by Original Medicare. Medicare Part A and Part B are free to most people, but out-of-pocket expenses can be high.

There are ten standardized Medigap plans available in Texas. The most comprehensive plan is Plan G. Plan G offers standard and high-deductible options. Plan G may also cover more out-of-pocket expenses. Medicare Plan G is the best Medicare Supplement plan in Texas for new enrollees.

Best Medicare Supplement Plans in Texas

Whether you’re new to Medicare or you’re already enrolled, you want to get the best Medicare Supplement Plan in Texas. This coverage will help pay for some of the out-of-pocket costs you’ll incur in Original Medicare.

When you’re looking for Medicare Supplement plans in Texas, you’ll want to make sure you’re choosing a policy that fits your specific health needs and budget. You’ll also want to make sure that your doctors are in network. If they’re not, you may be left with a higher out-of-pocket cost. You’ll also want to consider if you want coverage for out-of-state specialty clinics.

To help you find the best Medicare Supplement Plans in Texas, MoneyGeek compared the average costs of each plan and evaluated its coverage. They also created a comparison chart for each type of plan.

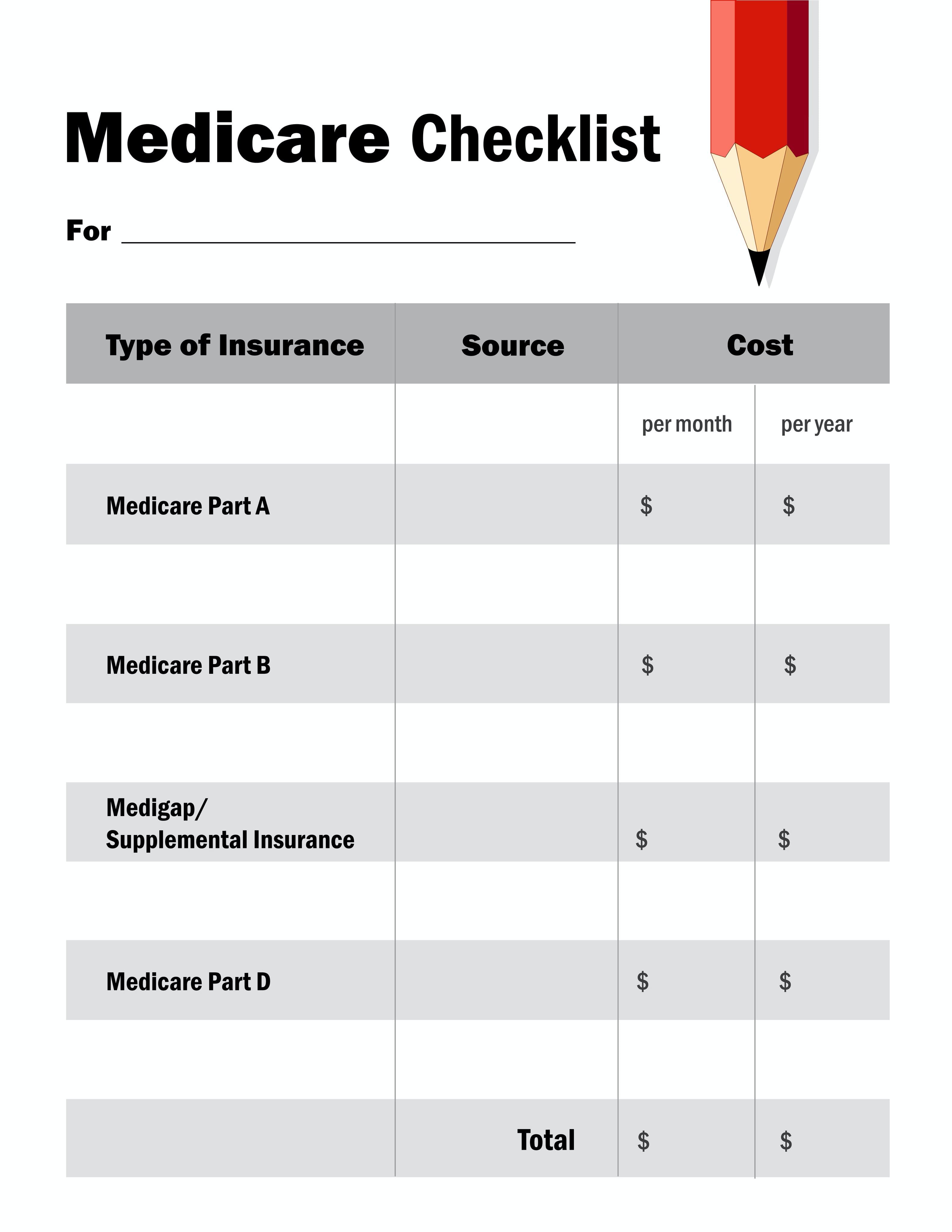

Eligibility checklist for Medicare Supplemental Plans in Texas

Having a solid grasp of the ins and outs of Medicare Supplemental plans in Texas is no small feat. In fact, there are a number of state-sponsored programs designed for specific geographies. For example, Medicaid is the state’s largest provider of health care services for low-income pregnant women. This means you can expect coverage at least equal to your state’s per capita income, and that’s assuming you qualify.

To make the best possible choice, you’ll need to know exactly what you’re looking for. In the process, you’ll enlist the aid of a qualified health insurance salesperson. In fact, some insurance companies offer a free health assessment to make sure you’re not missing out on coverage you need, but may not be eligible for.

How to Choose a MediGap Plan in Texas?

Choosing a Medicare Supplemental Plan in Texas can be complicated. Several factors can affect the cost of the plan, including your age and gender. A licensed agent can help you find the best plan for your situation.

Medicare Supplement plans work with Original Medicare to help pay for medical costs that are not covered by the original plan. There are ten types of Medigap plans available in Texas. Each type of plan offers different levels of coverage.

The National Association of Insurance Commissioners published loss ratios for 2021 Medicare Supplement plans. These numbers can help you choose the plan that best suits your needs. AARP/UnitedHealthcare is one of the best Medigap providers in Texas and the nation. They offer a range of plans with a high level of customer satisfaction.

What is the cost of Medicare Plan G in Texas?

Whether you are new to Medicare or looking to switch to a different Medicare plan, it’s important to compare the costs and benefits of Medigap plans in Texas. You’ll find that costs will vary depending on your age and plan level of coverage.

Plan G is gaining in popularity. Most insurance providers offer it, but not all offer online quotes. It is also cheaper than Plan F. Typically, Plan G starts paying benefits after $2,490 in medical care.

You can purchase Plan G in Texas from 47 providers. The average cost for a 65 year old non-smoking female is about $147 per month. However, rates vary widely. The rate for a 65 year old female in Austin without tobacco use is $95 to $417 per month.

The 10 Standard Medicare Supplement Insurance Plans

Choosing the right Medicare supplement insurance plan will depend on your health, your budget, and your medical needs. Medicare Supplement plans will help you fill in the gaps left by Medicare Parts A and B.

Medigap plans are sold in most states. Plans are sold during the six-month Medigap Open Enrollment Period. However, some insurers can deny coverage after open enrollment has ended. During the open enrollment period, the policy must meet federal rules. In some states, you will also have to meet medical underwriting requirements.

The Most Popular Plan: Plan G

Plan G is the most popular Medigap plan. This plan covers the Medicare Part A deductible and part of the Part B deductible. In addition to this, the plan will pay for doctor visits and outpatient medical treatment. The policy will also pay for blood tests. Plan G has a low monthly premium. However, it also comes with a high deductible.

The Cheapest Plan: Plan N

Plan N is the second most popular Medicare Supplement plan. This plan is cheaper than Plan G, but also comes with copayments for some office visits. The policy also pays for 20% of the Part B coinsurance. The plan has a small monthly premium, but the out-of-pocket costs can be high.

Plan F is one of the best

Is medicare supplemental plan F still available?

Plan F is one of the best Medicare Supplement plans. This plan helps you pay for Medicare Part B coinsurance costs. Plan F is available only if you became eligible for Medicare before January 1, 2020. If you are already enrolled in Medicare, you will not have to give up Plan C or Plan F. Alternatively, you may choose to buy Plan G.

Medigap plans are sold by private insurance companies. They must be approved by CMS, and the policy must clearly state that it is “Medicare Supplement Insurance”. Typically, these policies offer a range of cost-sharing options, and they may be able to exclude coverage for certain medical conditions for a limited period of time.

Medigap plans generally do not cover long-term care, vision, hearing aids, private-duty nursing, or prescription drug coverage. They also don’t include dental coverage. If you’re considering buying a Medicare Supplement policy, it’s important to compare rates and add-ons to find a plan that meets your needs. If you’re considering Medicare Supplement policy, you should also consider adding a policy that will pay for the Medicare Part A deductible. The best Medicare Supplement policy will cover your medical needs and help protect you from a huge hospital bill.

The best time to buy a Medicare Supplement policy is during the open enrollment period. There are some states that allow you to purchase a plan before 65 years of age. Also, you should be aware that some companies will raise your premiums more quickly as you get older.

Who Has the Best Medicare Supplemental Plan in Texas?

What’s the best Medicare Supplement company in Texas?

Choosing the best Medicare supplemental plan in Texas can be a tricky process. The plan you choose can vary depending on your age, gender, county, and even the insurance provider. It’s important to shop around to find the best price. You should also consider any discounts the provider may offer. You should also contact a company representative to get more information about a plan.

AARP/UnitedHealthcare is the most popular Medigap provider in Texas. They offer a range of benefits, including dental and foreign travel emergency coverage. Their rates are moderate. Those who want guaranteed issue enrollment can go with an AARP/UHC plan. They are ranked as one of the best providers nationally.

Blue Cross and Blue Shield of Texas has a 19% enrollment. They offer Medigap plans that offer a 9% discount. However, the plan requires the member to live within 30 miles of an in-network hospital. This could cause more out-of-pocket expenses.

Mutual of Omaha is another popular Medicare Supplement plan in Texas. Their rates are lower for non-tobacco users. They also offer four plan options.