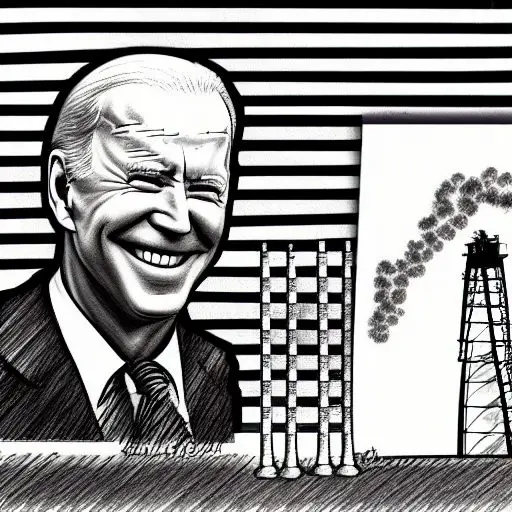

Oil prices are poised to rise in the shadow of OPEC production cuts. As the Biden administrations continues its war on domestic fossil fuel production, there’s no where for oil prices to go, but up. The administration continues to draw oil out of the strategic petroleum reserves to artificially depress prices prior to the election on November 8th. To counter the draw out of the strategic reserves, OPEC took action to immediately cut production by two million barrels a day, citing lessening demand for its product. This was a very strategic move as the U.S. has drawn down over half of its reserves.

Domestic oil producers don’t seem to be reacting to higher oil prices

As of Oct 7, 2022, the latest rig count in the US remained steady at 762 rigs in operation. 13 active offshore oil rigs and three rigs on inland waters are currently in operation. Oil producers remained cautious as the administration continues to roll out burdensome regulations that make it difficult to drill, especially on federal lands. The mood in D.C. is having a severe dampening effect on domestic production in the states. The political climate is very hostile against oil producers and investors aren’t putting as much money into oil producing companies like they have in years past.

Without a significant change in national policy, oil and gas prices will remain elevated (because there’s not enough supply to bring prices down). The administration simply refuses to discuss domestic production with its oil companies, and honestly, would like to see them all go out of business. For some reason, the Biden administration decided to engage Saudi Arabia and Venezuela to solve its economic woes. Woes that continue to severely handicap the productivity of the country. In recent weeks, Biden courted both countries without much success.

Without a significant decline in oil prices, inflation will remain elevated and persist well into the foreseeable future.

Does Biden want high prices at the pump

Unfortunately, the administration blocked the Keystone XL pipeline early in the administration. This sent an immediate and hostile signal to oil producers across the country. Additionally, the administration blocked the Alaskan Anwr (Arctic National Wildlife Refuge) project. Important, because Anwr has an estimated 10 billion barrels of oil–more than enough to bring prices down. The administration also continues to stop critical leases that are needed to maintain our current energy supply. The reason the administration is seeking high energy prices is to stimulate electric vehicle production with the hope that America will some day go 100% green. While it’s unlikely to happen, near term, Americans will continue to suffer higher prices across the board. Lastly, the draw from the strategic petroleum reserves will likely end after the November elections, which will cause gas and oil prices to increase dramatically.